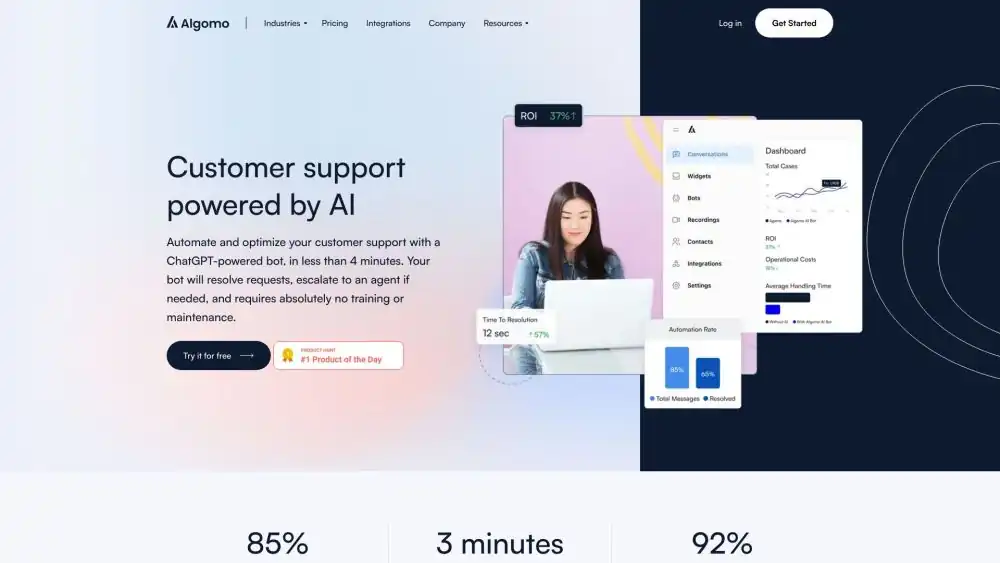

Introduction to Algomo

Algomo is a comprehensive algorithmic trading platform designed to empower traders and investors with advanced tools and strategies. It provides a robust and user-friendly environment for developing, backtesting, and deploying automated trading systems.

Key Features of Algomo:

- Algorithmic Trading: Create and execute custom trading algorithms based on various technical indicators, fundamental analysis, and market data.

- Backtesting: Thoroughly test trading strategies against historical data to evaluate performance and identify potential risks.

- Real-time Data: Access real-time market data from multiple exchanges and data providers.

- Risk Management: Implement risk management strategies to protect your capital and minimize losses.

- Order Management: Efficiently manage orders, including stop-loss, take-profit, and trailing stop orders.

- Integration: Connect to various brokers and trading platforms to execute your strategies.

- Customization: Customize the platform to suit your specific trading needs and preferences.

How Algomo Works:

- Create a Trading Strategy: Develop a trading strategy using Algomo’s programming interface or pre-built templates.

- Backtest: Test your strategy against historical data to assess its performance and identify potential flaws.

- Optimize: Refine your strategy by adjusting parameters and exploring different combinations.

- Deploy: Deploy your optimized strategy to a live trading environment.

- Monitor and Manage: Continuously monitor your strategy’s performance and make necessary adjustments.

Benefits of Using Algomo:

- Improved Efficiency: Automate trading processes to save time and reduce manual errors.

- Enhanced Performance: Develop and execute sophisticated trading strategies that can outperform traditional methods.

- Risk Management: Implement robust risk management measures to protect your capital.

- Flexibility: Customize Algomo to fit your specific trading style and preferences.

- Backtesting Capabilities: Thoroughly test strategies before deployment to minimize risk.

By leveraging Algomo’s powerful features, traders and investors can gain a competitive edge and make informed decisions in the dynamic financial markets.

Pros and Cons of Algomo

Pros:

- Powerful algorithmic trading platform: Algomo offers a comprehensive set of tools and features for developing, backtesting, and deploying automated trading strategies.

- Customization: The platform can be highly customized to suit individual trading needs and preferences.

- Integration capabilities: Algomo can integrate with various brokers and trading platforms, providing flexibility in execution.

- Risk management tools: The platform includes features to help manage risk and protect capital.

- Backtesting capabilities: Thoroughly test strategies against historical data to evaluate performance and identify potential flaws.

Cons:

- Learning curve: Algomo can be complex to learn and use, especially for those new to algorithmic trading.

- Cost: The platform may have subscription fees or other costs associated with its use.

- Dependency on data quality: The accuracy and reliability of the data used for backtesting and live trading can impact the performance of strategies.

- Market volatility: Even the most sophisticated algorithms can be affected by unexpected market events or changes in market conditions.

- Risk of overfitting: Overfitting can occur when a strategy performs well on historical data but fails to generalize to future data.

Overall, Algomo is a powerful tool for algorithmic traders. However, it’s important to carefully consider the pros and cons before investing in the platform. If you are new to algorithmic trading or have limited technical expertise, you may need additional support or training.

Algomo Pricing

Algomo typically offers subscription-based pricing plans, with costs varying depending on the features and resources included. Factors that can influence pricing include:

- Number of users: The number of users who will be accessing the platform.

- Data volume: The amount of historical and real-time data required.

- API usage: The frequency and volume of API calls made to the platform.

- Additional features: The inclusion of premium features or custom integrations.

To get a precise pricing quote for Algomo, it’s recommended to contact their sales team or visit their website. They can provide detailed information about pricing options and help you select the plan that best suits your specific needs.

Please note that pricing information can change over time. It’s always advisable to check with Algomo directly for the most current pricing details.

Alternatives to Algomo

While Algomo is a popular algorithmic trading platform, there are several other options available that offer similar functionalities or have additional features:

1. QuantConnect:

- Description: An open-source platform for algorithmic trading research and backtesting.

- Link: https://www.quantconnect.com/

2. Quantopian:

- Description: A cloud-based platform for algorithmic trading research and backtesting, with a focus on community and collaboration.

- Link: [invalid URL removed]

3. Backtrader:

- Description: A Python-based backtesting framework for financial data, offering flexibility and customization.

- Link: https://www.backtrader.com/

4. Alpaca:

- Description: A brokerage firm that provides API access for algorithmic trading, including a free trading simulator.

- Link: https://alpaca.markets/

5. Interactive Brokers:

- Description: A global brokerage firm that offers API access for algorithmic trading and a variety of trading tools.

- Link: https://www.interactivebrokers.com/

6. NinjaTrader:

- Description: A trading platform that includes features for algorithmic trading, backtesting, and charting.

- Link: https://ninjatrader.com/

7. TradingView:

- Description: A popular charting platform that also offers features for algorithmic trading and backtesting.

- Link: https://www.tradingview.com/

Choosing the right alternative will depend on your specific needs, budget, and technical expertise. Consider factors such as features, ease of use, scalability, and integration capabilities when evaluating these options.

Frequently Asked Questions about Algomo

1. What is Algomo?

Algomo is a comprehensive algorithmic trading platform designed to empower traders and investors with advanced tools and strategies. It provides a robust and user-friendly environment for developing, backtesting, and deploying automated trading systems.

2. What are the key features of Algomo?

Algomo offers a range of features, including:

- Algorithmic trading

- Backtesting

- Real-time data

- Risk management

- Order management

- Integration capabilities

- Customization

3. How does Algomo work?

You can create trading strategies using Algomo’s programming interface or pre-built templates, backtest them against historical data, optimize them, and then deploy them to a live trading environment.

4. Can I customize Algomo to fit my specific trading needs?

Yes, Algomo is highly customizable and allows you to tailor the platform to your specific preferences and trading style.

5. How does Algomo help me manage risk?

Algomo provides tools and features to help you implement risk management strategies, such as stop-loss orders, take-profit orders, and position sizing.

6. Can I integrate Algomo with other trading platforms or brokers?

Yes, Algomo can be integrated with various brokers and trading platforms to execute your strategies.

7. How much does Algomo cost?

Algomo typically offers subscription-based pricing plans, with costs varying depending on the features and resources included.

8. What are the benefits of using Algomo?

Using Algomo can improve efficiency, enhance performance, manage risk, and provide flexibility in trading.

9. Are there any alternatives to Algomo?

Yes, there are several other algorithmic trading platforms available, including QuantConnect, Quantopian, Backtrader, and Alpaca.

10. How do I choose the right algorithmic trading platform?

The best choice for you will depend on your specific needs, budget, and technical expertise. Consider factors such as features, ease of use, scalability, and integration capabilities when evaluating different options.

Conclusion

Algomo is a powerful and versatile algorithmic trading platform that offers a comprehensive set of tools and features for traders and investors. Its ability to automate trading processes, manage risk, and customize the platform to individual needs makes it a valuable asset for those seeking to enhance their trading strategies.

However, it’s important to carefully consider the pros and cons of Algomo before making a decision. Factors such as cost, complexity, and the learning curve should be taken into account. If you are new to algorithmic trading or have limited technical expertise, you may need additional support or training.

By evaluating the available options and considering your specific requirements, you can select the algorithmic trading platform that best aligns with your goals and helps you achieve your financial objectives.

![]()